Affiliate Pay Policies

Affiliate Payments

This explains how we determine when affiliate earnings are eligible and when we issue those payments.

We will only calculate the exact value of your payment on the last day of each month for commissions that are at least 90 days old.

When is payday?

We process affiliate earnings during regular business hours, as outlined below.

- We calculate commissions based on the last day of the month.

- Payments are issued between the 1st and the 10th of the following month.

- Delays: We will always process your payments as soon as humanly possible. If we anticipate a delay extending past the 10th of the month, we will notify affected affiliates via email. Also, please see Delays Without Notice below.

Frozen Funds—Affiliates not in compliance with tax documentation requirements or violating our operating agreement will have their funds frozen. We will notify affected affiliates so they can bring their accounts into compliance. Failure to respond by the deadlines outlined in our email notification and or failure to bring your activities into compliance with our Affiliate Operating Agreement and Acceptable Use Policies may result in us suspending your account and the forfeiture of your funds.

Regular operating hours are Monday through Thursday, 9 AM to 5 PM Central Standard Time. We are closed on Fridays and all US and observed holidays. The days we are closed may vary around major holidays such as Christmas.

Delays without notice. We will always do our best to pay on time. However, events beyond our control may interrupt our ability to access our systems to process your payments. Events beyond our control include, but are not limited to, Natural disasters, "Acts of God," war, banking system interruptions, regional internet access and communication disruptions, regional power failures, accidents that prevent trained personnel from accessing our systems, etc.

What is an eligible earning?

An Eligable earning is a commission that has met the following criteria.

- Is at least 90 days old.

- AND.

- The total adds up to a minimum of $75.

Balances that meet these criteria on the last business day of the month will be paid during the upcoming pay cycle. If your balance is below $75, we will hold your earnings until your eligible balance meets or exceeds the $75 minimum.

For new affiliates, your first potential payday is 90 days after your commission balance is a minimum of $75 and has no returns deducted against it.

Payments Tab

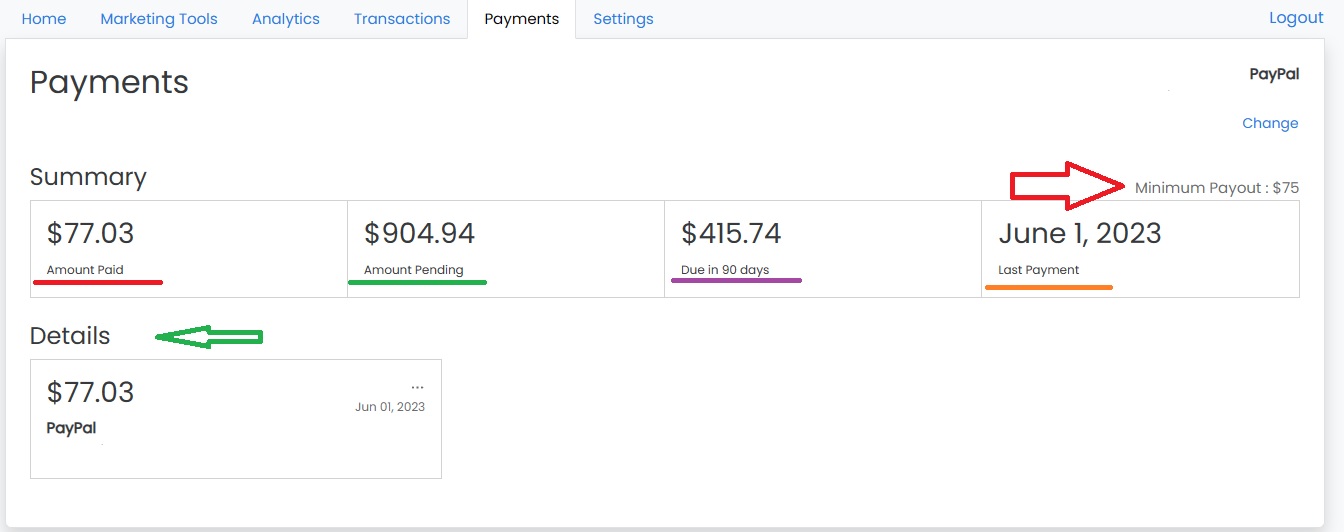

The payments tab summarizes your basic totals.

Amount Paid - underlined in Red.

This section shows the total amount you have been paid since joining.

Amount Pending - underlined in Green.

The Amount Pending section is a live calculator and does not provide a fixed notification for your next commission payment. When you view the report, it calculates the total commissions qualifying for payment at that time. The report is adjusted continuously as new earnings become eligible and are added, and returns are deducted.

Due in 90 Days - underlined in Purple.

These are commissions currently within the 90-day waiting period. This total is also adjusted continuously until payday as commissions mature past 90 days and are moved to the Amount Pending section.

Last Payment - underlined in Orange.

This section shows the date of your last payment.

Minimum Payout - Red Arrow.

Shows the minimum amount that must show in Amount Pending to be eligible for payment on the first of the month.

Details - Green Arrow.

Shows your payment history.

Estimating a Payday - When & How Much.

The Current Payday

We do not know how much you will be paid until the day we issue payment because commission calculations are updated in real-time. The final value of your payment is not set until we send payment.

Will I have a payday this month?

The consistency of your payments depends entirely on your monthly volume.

- Affiliates with low volume or inconsistent sales will not likely be paid every month. If your accumulated payable commissions are under $75 on payday, we will roll it over each month until it totals at least $75. If you would like a forcast of your next potential payday please email us at admin@healthnatura.com for an estimate.

- Mature and high-volume affiliates who have developed consistent volume over $75 will be paid the first business day of each month.

Why 90 Days & Why Returns Count Against Your Earnings.

We allow customers to return products for 90 days. Unlike traditional advertising or pay-per-click advertising, our affiliate program is a form of profit sharing where we pay you a percentage of the order value generated by your referrals. If a customer receives a refund, your commission is adjusted based on the refund amount. The holding period between the sale and when the commission is payable lets us ensure your commission balance doesn't become negative.

This system may not seem fair from an affiliate's perspective; unfortunately, it is a retail reality. People change their minds or want their money back for various reasons. Even after you have done your part to attract customers and we have done ours to finalize the order, people can change their minds and leave our combined businesses at a financial loss. Fortunately, our refund rate is very low.

Why A Minimum Payable Balance of $75?

Two significant benefits of our program are that we pay high commissions and require a low balance to receive a payout. Another benefit of our program is that we do not charge our affiliates payment transaction fees. Transferring money from our account to yours costs money, and the smaller the transfer value, the more expensive it is for us to process payments. Setting a minimum payout balance means we can pay you a higher commission and not charge you a money transfer fee. We've attempted to balance paying you your earnings and controlling transaction costs by setting the minimum payable balance at a relatively low $75.